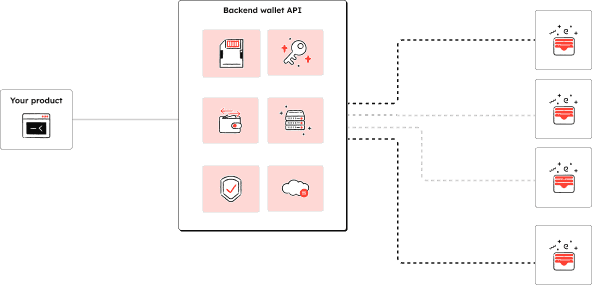

You can now execute onchain actions at scale directly from your server. Backend Wallets allow applications to automate transactions, manage treasuries, and sponsor gas without requiring manual user signatures for every operation.

What is an Openfort Backend Wallet?

A Backend Wallet is a secure, developer-controlled account that lives on your server rather than in a user's browser. It is designed for high-performance automation—such as minting NFT rewards for thousands of players, distributing stablecoin payments, or managing protocol liquidity. At Openfort, our backend wallets are secured using Google Cloud TEE (Trusted Execution Environment) hardware, ensuring that your private keys remain isolated and untouchable while executing hundreds of signatures per second.

What are Backend Wallets?

Backend wallets are developer-controlled accounts that run on your server, enabling automated blockchain interactions without manual user input. Unlike traditional user wallets, they:

- Operate programmatically via APIs.

- Support gasless transactions via ERC-2771 forwarders or ERC-4337 paymasters.

- Manage assets at scale for use cases like treasury systems, NFT drops, or cross-chain operations.

Why Openfort’s backend wallets?

Our infrastructure combines EOA flexibility and ERC-4337 smart account capabilities to address critical onchain challenges:

- Automated Transactions: Execute batch mints, disbursements, or trades without user signatures.

- Gas Abstraction: Sponsor gas fees via custom forwarders or Openfort’s paymaster.

- Enterprise Security: Custodial wallets with Google Cloud TEE-based key management.

- EVM Compatibility: Seamlessly deploy on Ethereum, Polygon, Base, and other EVM chains.

Key features & architecture

Secure key management

- Google Cloud TEE backend: Private keys are secured in Trusted Execution Environments (TEEs), ensuring cryptographic operations remain isolated from external threats.

- Custody flexibility: Choose between custodial EOAs (ideal for treasury management) or non-custodial options with verified ownership.

Cross-chain scalability

While currently focused on EVM chains (Ethereum, Polygon, Base), Openfort’s infrastructure is designed for future expansion to non-EVM networks like Solana and Bitcoin.

Policy engine & transaction controls

- Granular rules: Enforce allowlists, transaction limits, or contract-specific interactions.

- Idempotent execution: Prevent duplicate transactions with built-in deduplication.

- State sync: Monitor transaction statuses in real time via webhooks or Websockets.

High performance infrastructure

- Below 300ms signature times: Optimized cryptographic libraries ensure low-latency operations.

- Four 9s uptime: Globally distributed nodes guarantee reliability for mission-critical applications.

Key use cases

1. Treasury management

- Automate payroll in stablecoins.

- Manage protocol-owned liquidity pools.

- Distribute rewards or refunds programmatically.

2. NFT operations at scale

- Batch-mint NFTs for gaming items or collectibles.

- Update dynamic metadata (e.g., evolving in-game assets).

- Airdrop assets to user wallets post-purchase.

3. Shared & automated wallets

- Collaborative Control: Configure multi-party approval (m-of-n) for DAO treasuries or institutional wallets.

- AI-Driven Agents: Program wallets to execute stop-loss trades, recurring payments, or DeFi strategies.

4. Cross-Border Payment Systems

- Manage millions of wallets for users or machines.

- Automate stablecoin disbursements with gas sponsorship.

Advanced capabilities

Automated Gas Sponsorship

- Never manually top up wallets. Use Openfort’s paymaster to dynamically fund transactions.

- Define policies to sponsor gas for specific users, contracts, or transaction types.

Flexible custody models

- Custodial EOAs: Retain full control for internal operations (e.g., treasury accounts).

- Non-Custodial Options: Verify ownership via signed messages for user-assigned wallets.

Multi-chain event listeners

- Register webhooks to track onchain events (e.g., incoming payments, contract interactions).

- Sync wallet states across frontend and backend systems in real time.

Why developers choose Openfort

- Unified APIs: Manage EOA and ERC-4337 wallets with one SDK.

- Zero Infrastructure Overhead: No need to self-host relayers or signers.

- Multi-Chain Ready: Currently EVM-focused, with seamless chain switching.

Related reading

- OpenSigner: vendor-neutral key management for non-custodial wallet infrastructure

- TEE wallets and how trusted execution environments secure private keys

- Building AI agents with wallets for autonomous onchain operations